student loan debt relief tax credit application 2021

For unsafe financial obligations such as credit cards individual car loans particular personal trainee loans or other similar a financial debt relief program might offer you the service you. For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund.

Click Now Apply Online.

. It was founded in 2000 and has since become a. August 12 2022 Student Debt E-book. Student Loan Debt Relief Tax Credit for Tax Year 2021 Details Instructions I.

Make a one-time payment for the amount of tax credit to lender. Maryland taxpayers who maintain Maryland residency for the 2022 tax year. If you pay taxes in Maryland and took out 20K or more in debt to finance your post-secondary education apply for the Student Loan Debt Relief Tax Credit.

When setting up your online account do not enter a temporary email address such as a workplace or college. Entering more than one application in the same application year puts your application at risk of being eliminated. Understanding Your Student Loans.

For tax financial debt relief CuraDebt has an incredibly professional group resolving tax financial obligation issues such as audit defense complicated resolutions offers in concession deposit. Student loan debt relief tax credit individuals that have at least 20000 in undergraduate or graduate student loan or both debt may qualify for the credit. Ad Use our tax forgiveness calculator to estimate potential relief available.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Read Expert Reviews Compare Student Loan Repayment Options. About the Company Student Loan Debt Relief Tax Credit Application 2021.

Under Maryland law the. Enter the total remaining balance on all undergraduate andor graduate student loan debt which is still due as of the submission of this application. Ad Best Repayment Programs Compared Scored.

Recipients of the Student Loan Debt Relief Tax Credit have two options for debt repayment. Student Loan Debt Relief Tax Credit for Tax Year 2021 Details Instructions I. Do not abandon an application that you already started.

CuraDebt is a company that provides debt relief from Hollywood Florida. To qualify you must be making. CuraDebt is a debt relief company from Hollywood Florida.

If you pay taxes in Maryland and took out 20K or more in debt to finance your post-secondary education apply for the Student Loan Debt Relief Tax Credit. Explore exclusive scholarships in New Jersey to forgive student debt. Have at least 5000 in outstanding student loan debt upon applying for the tax credit.

This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. Ad Students at all education levels will be considered for the 25k Debt Relief Grant. Have the debt be in their the Taxpayers name.

About the Company Student Loan Debt Relief Tax Credit Application. Claim Maryland residency for the 2021 tax year. Maryland Adjusted Gross Income.

When setting up your online account do not enter a temporary email address such as a workplace or. Ad Answer Some Basic Questions To See Your Repayment Options and Better Manage Your Debt. Easily Pay Your Student Loan Now.

Jun 29 2021 The Student Loan Debt Relief Tax Credit is a program open to Maryland taxpayers who are either full-year or part-year residents of that state. It is important to understand the basics of student loans and the types of loans available. It was established in 2000 and is a part of the.

Find Your Path To Student Loan Freedom. Complete the Student Loan Debt Relief Tax Credit application. Ad No Money To Pay IRS Back Tax.

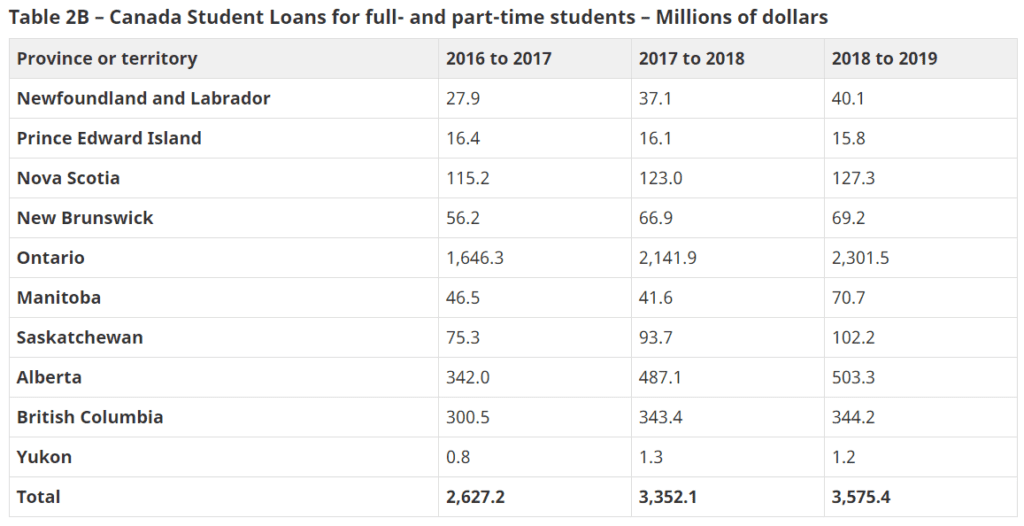

Student Loan Forgiveness In Canada Loans Canada

Can I Get A Student Loan Tax Deduction The Turbotax Blog

The Government Can Help You With Your Student Loans Find Out How Student Loans Student Loan Repayment Student Loan Debt

Student Loan Debt Forgiveness In Canada Consolidated Credit Ca

Is There Tax Savings For The Interest On Student Loan Debt Consolidated Credit Ca

Student Loan Forgiveness In Canada Loans Canada

Student Loan Debt Forgiveness In Canada Consolidated Credit Ca

My Plan To Cancel Student Loan Debt On Day One Of My Presidency Elizabeth Warren

Covid 19 Relief Bill Passes With Tax Free Status For Student Loan Forgiveness

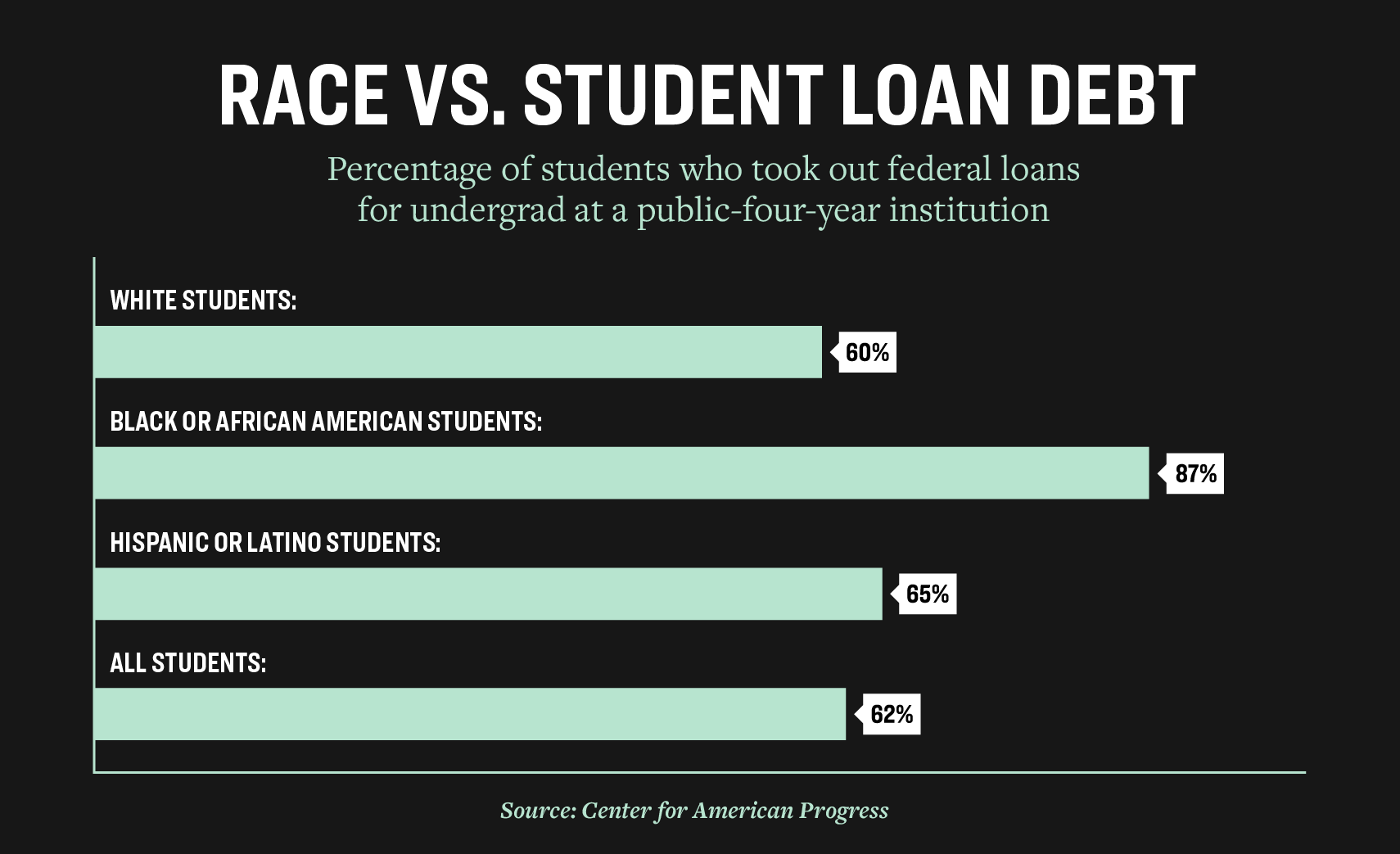

Who Owes All That Student Debt And Who D Benefit If It Were Forgiven

Can I Get A Student Loan Tax Deduction The Turbotax Blog

President Biden Extended The Student Loan Payment Freeze Until May 2022 Nextadvisor With Time

Prodigy Finance Review International Student Loans International Student Loans Refinance Student Loans Millennial Personal Finance

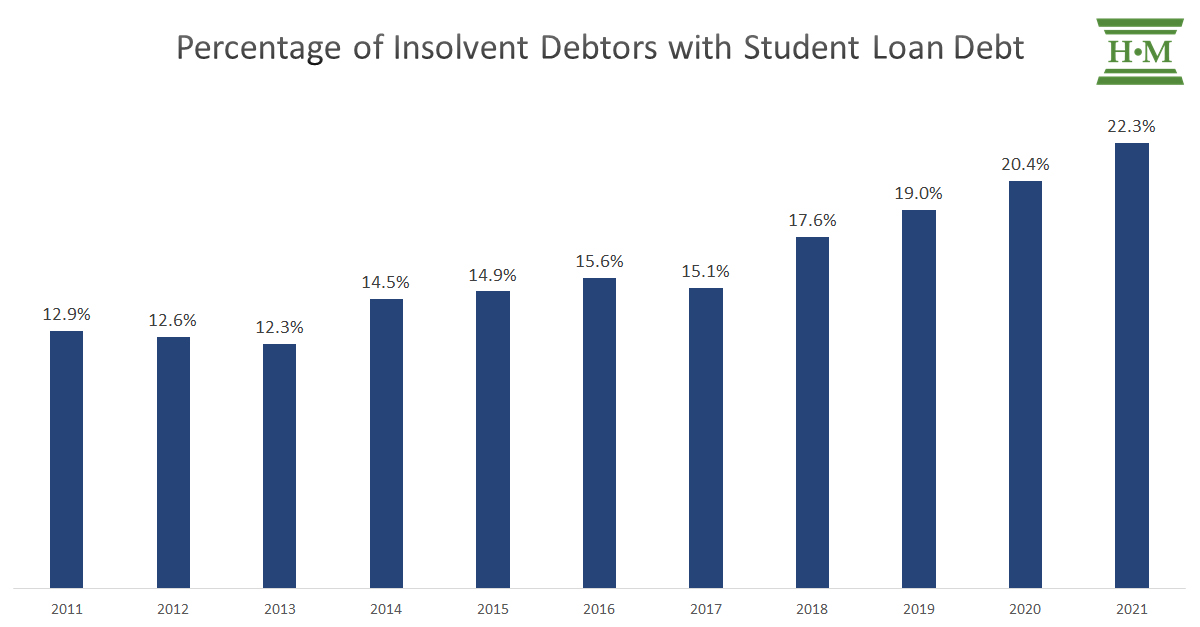

2021 Joe Debtor Bankruptcy Study Who Files Bankruptcy Why Hoyes Michalos

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

Student Loan Forgiveness In Canada Loans Canada

Get A Game Plan For Paying Student Loan Debt In 2021 Paying Student Loans Student Loan Debt Student Debt